are union dues tax deductible in 2020

Tax reform eliminated the deduction for union dues for tax years 2018-2025. Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union.

Deducting Union Dues Drake17 And Prior

You can claim a tax deduction for.

. The states official tax instruction book confirms union dues can still be deducted from state taxes subject to itemizing and if your miscellaneous deductions exceed two percent of your. Can you write off union dues on your taxes. Tax reform changed the rules of union due deductions.

This is in response to an email we received from Craig Mutter on November 23 2020 and our discussion. The answer to your question is that the deduction for union dues and all employee expenses has been eliminated for tax years 2018 through 2025 regardless of whether an. Im a union Ironworker Ill be filing single and have made 41000 will my tools welding hoods etc still be a deduction and will my union dues be a deduction as well.

For tax years 2018 through 2025 union dues are no longer deductible on your federal income tax return even if itemized deductions are taken. On certain bonds such as bonds that pay a variable rate of interest or that provide for an interest-free period the amount of bond premium allocable to a. A reminder for tax season.

As a result of the Tax Cuts and Jobs Act TCJA that Congress passed and was signed into law on December 22 2017 employees can no longer deduct union. Brigitte Richer 2020-087195. This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall.

Deduction for excess premium. The amount of union dues that you can claim is shown in box 44 of your T4 slips or on your receipts and includes any GSTHST you paid. Tax reform changed the rules of union due deductions.

Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your. Tax Deduction of Your TALB Dues. For tax years 2018 through 2025 union dues and all employee expenses are.

However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that. Can I deduct my union dues in 2020. Are union dues tax deductible 2020.

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. Union dues are no longer tax deductible. Line 21200 was line 212 before tax year 2019.

June 3 2019 1127 AM. UnionMembership fees are tax deductible If you pay work-related union or membership fees you can claim the total cost of these fees. However if the taxpayer is self.

Job-related expenses arent fully deductible as. Under current federal law employee business expenses are generally not deductible. For tax years 2018 through 2025 union dues and all employee expenses are.

Deduction of union dues. That is the deductibility has been suspended for tax years 2018 through 2025. If you are an employee you can claim your union dues as a job-related expense if you itemize deductions.

Why All Workers Should Be Able To Deduct Union Dues Center For American Progress

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Top Tax Deductions For Nurses Rn Lpn More Everlance

Union Dues Are Now Tax Deductible Ibew 1249

New Bill Would Restore Tax Deduction For Union Dues Other Worker Expenses

Supplement To J K Lasser S 1 001 Deductions And Tax Breaks 2022

Membership Dues Tax Deduction Info Teachers Association Of Long Beach

Please Calculate The Employer S Crapayroll Expense For The Paycheque Course Hero

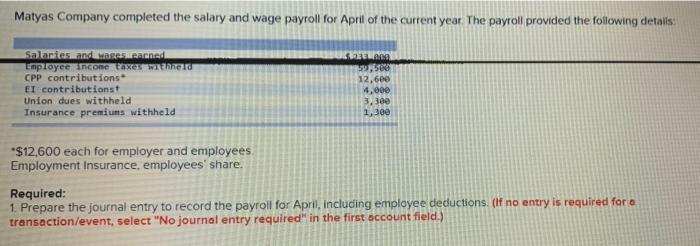

Solved Matyas Company Completed The Salary And Wage Payroll Chegg Com

Deductions Worksheet Fill Online Printable Fillable Blank Pdffiller

/MostOverlookedTaxDeductions-29f2eea9bc044c90b9f5593fb267005a.jpg)

The Most Overlooked Tax Deductions

Union Dues Deductible On State Taxes Not On Federal Taxes Hawaii State Teachers Association

What Tax Deductions Can Teachers Take Write Off List Tips

Tax Strategies For Parents Of Kids With Special Needs The Autism Community In Action Taca

Solved Pls Help Thank You Taxation Course Hero

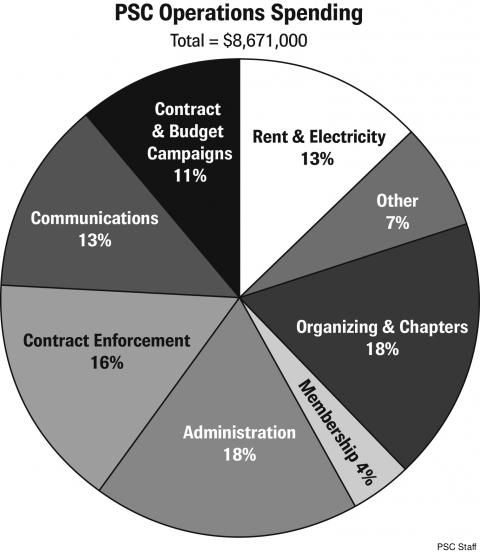

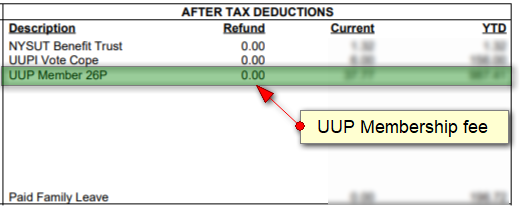

Deducting Union Dues On Nys Taxes Uup Buffalo Center

Union Dues Do Not Here Reduce Income For C S S A Purposes Divorce New York

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)